Are you nearing retirement with a significant nest egg and feeling anxious about the upcoming election’s impact on your investments? Remember, money isn’t red or blue, it’s green. Don’t let the political noise cloud your long-term financial security. This article provides a roadmap for investors with $1 million+ in investable assets, navigating market volatility and building a resilient retirement plan.

Beyond the Election Cycle: Understanding Market Complexities

While elections can introduce uncertainty, they’re just one factor influencing the intricate ecosystem of financial markets. Geopolitical events, economic data releases, and Federal Reserve policy adjustments all play a crucial role. Here’s where a sophisticated approach surpasses basic election-centric worries:

- Black Swan Events and Portfolio Diversification: Elections are predictable compared to unforeseen “black swan” events – highly improbable occurrences with massive consequences. McAdam Financial employs advanced diversification strategies that go beyond traditional asset classes, incorporating alternative investments to help mitigate exposure to such unpredictable events.

- Market Inefficiencies: The efficient market hypothesis suggests markets are perfectly priced, leaving no room for superior returns. In some cases, McAdam Financial leverages expertise to mitigate the risk of a market correction using specific instruments to protect our clients’ retirement assets and help them achieve more consistent returns.

Data-Driven Retirement Planning for the Savvy Investor

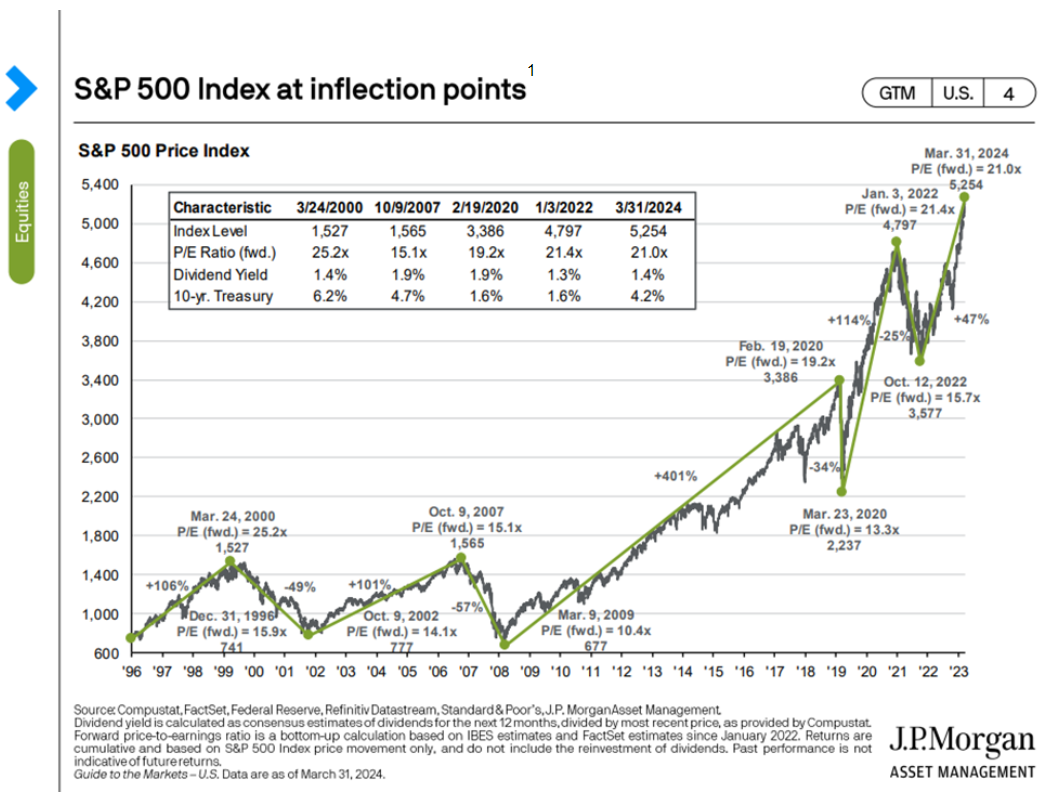

While historical data shows the S&P 500’s positive average returns under various administrations, a forward-looking approach is paramount for investors like yourself. Past performance is no guarantee of future performance or success. It is not possible to invest directly in an index.

Here’s how McAdam Financial goes beyond historical averages:

- Monte Carlo Simulations: We use sophisticated Monte Carlo simulations to stress-test your portfolio against a myriad of market scenarios, including potential election-induced volatility and black swan events. This allows us to tailor your investment strategy for maximum resilience, helping your assets weather long-term market volatility and potentially extend the longevity of your financial resources to meet your ever-increasing life expectancy.

- Tax-Optimization Strategies: Elections can shake up tax laws, but McAdam Financial stays ahead of the curve. We analyze potential changes and use smart strategies like tax-loss harvesting to help minimize taxes. We may also suggest gradually moving your money from taxable accounts to tax-free ones (like Roth IRAs) over time. This helps you keep more of your hard-earned cash, boosting your retirement income.

Looking Beyond Traditional Asset Allocation

While traditional asset allocation is crucial, a seven-figure portfolio demands a more nuanced approach:

- Alternative Investments: McAdam Financial offers a broader range than the usual stocks and bonds available through many traditional money managers. Our investment options also feature indexed annuities and specially designed life insurance to help you diversify your portfolio further. This means you can spread your money out more effectively and potentially benefit from tax advantages you might not get with traditional investments.

McAdam Financial: Your Partner in Building a Secure Retirement

At McAdam Financial, we understand the unique challenges faced by high-net-worth individuals nearing or in retirement. Our team of experienced financial advisors specializes in crafting retirement spending models that reflect a significant paradigm shift from accumulation to decumulation. We go beyond short-term worries like elections and focus on long-term strategies for a comfortable retirement:

- Customized Investment Strategies: We tailor investment strategies that prioritize your income needs, risk tolerance, and long-term goals, helping to ensure your portfolio generates consistent income while preserving your capital.

- Advanced Portfolio Monitoring and Risk Management: Our team constantly monitors market movements and employs sophisticated risk management techniques to help minimize potential losses and safeguard your wealth.

- A Logic Based Model to Create a Comfortable Retirement: Forget the outdated 4% rule! McAdam Financial utilizes the “Spend, Protect, Grow” model, a nuanced approach for seven-figure portfolios. We strategically divide your assets into three categories: Spend for everyday needs, Protect against the unexpected, and Grow to keep pace with inflation and potentially increase your wealth. This data-driven approach goes beyond basic allocation and is designed to help craft a personalized retirement plan for a comfortable and secure future, free from short-term market worries.

- Legacy Planning and Intergenerational Wealth Transfer: Passing your wealth on to loved ones can be a complex process. We can help you navigate estate planning with advanced strategies to ensure a smooth transition of your assets to your beneficiaries, minimizing taxes along the way.

Schedule Your FREE Consultation Today!

Don’t let election noise paralyze you and render you unprepared. At McAdam Financial, we offer a free no-obligation consultation to discuss your retirement goals and how we can help you achieve them. Call 855-MCADAM5 now! Or click to schedule your consultation online.

1. https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

Written by McAdam Financial as of 6/18/24. This article is provided by McAdam LLC (“McAdam” or the “Firm”) for informational purposes only. Investing involves the risk of loss and investors should be prepared to bear potential losses. Past performance may not be indicative of future results and may have been impacted by events and economic conditions that will not prevail in the future. No portion of this article is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax, or legal advice. Certain information contained in this report is derived from sources that McAdam believes to be reliable; however, the Firm does not guarantee the accuracy or timeliness of such information and assumes no liability for any resulting damages. Any references made regarding the taxable nature of your investments should not be construed as tax advice. McAdam LLC is not a tax advisory firm; therefore, any tax decisions or assumptions should be made/verified with your tax professional. Effective tax rates are based off the 2024 tax table and determined using https://www.irs.gov/filing/federal-income-tax-rates-and-brackets.

Securities offered only by duly registered individuals through Madison Avenue Securities, LLC (MAS), member FINRA/SIPC. Investment advisory services offered only by duly registered individuals of McAdam, LLC, a registered investment advisor. Insurance products and services offered through McAdam Financial. McAdam, LLC and McAdam Financial are not affiliated with MAS.